Top 10 Baby Boomers’ Retirement Fears

As a baby boomer nearing retirement, you have some fears about the future. You stay awake all night, staring at the blank ceiling and wondering what the future has in store for you. Did you make the right financial decisions? Did you do everything that you should have done when you were younger? Are there things coming up that you won’t be able to handle?

Well, the first thing you should know is that what you are going through is perfectly normal. Many (if not all) baby boomers ask themselves those same questions with the same level of uncertainty. Even if you meet a baby boomer that seems to have it all figured out and organized, they have their own financial fears to deal with.

In fact, you would probably be surprised to find out that the top 10 retirement fears of baby boomers nowadays are probably some of the ones you are having! Take a look at these common fears, and see how many of them you can relate to. Hopefully it’s not all 10!

Fear No. 1: I Can’t Afford the Healthcare That I Need

As baby boomers age, their health will deteriorate over time despite their best efforts to live a healthy lifestyle. Some are the unfortunate victims of terminal diseases that include certain types of cancers, or degenerative diseases such as Alzheimer’s. Treatments and medications are not getting any less expensive, and even with full insurance coverage there’s still a hefty price to pay for all those doctor visits and extended stays at the hospital.

Fear No. 2: I Didn’t Start Investing Earlier, And Won’t Be Able to Benefit from Compound Growth

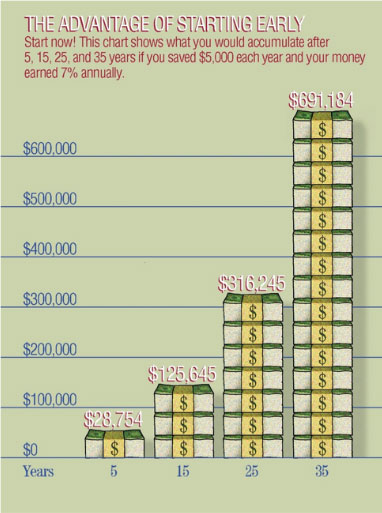

Many baby boomers walk into retirement with a massive feeling of regret about not investing when they were younger. In particular, many wish that they had started putting money away the second they started working, that way the money could accumulate a generous portion of interest. As you can see in the diagram below, starting early results in exponential growth overtime. You don’t have to invest $5000 per year, but the point still remains.

Fear No. 3: I Don’t Have Enough Money Saved Up

Even if you did everything right and managed to save money over the years, there is the nagging worry that it won’t be enough to last through retirement. Baby boomers are living to see a longer duration of retirement before they pass, and they will need some form of cash flow in order to maintain their lifestyles.

Fear No. 4: I’ll Never Be Able to Stop Working and Retire

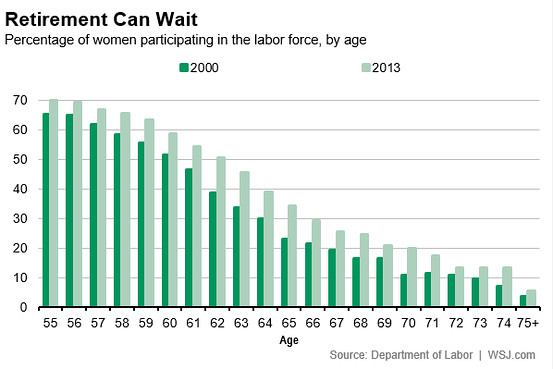

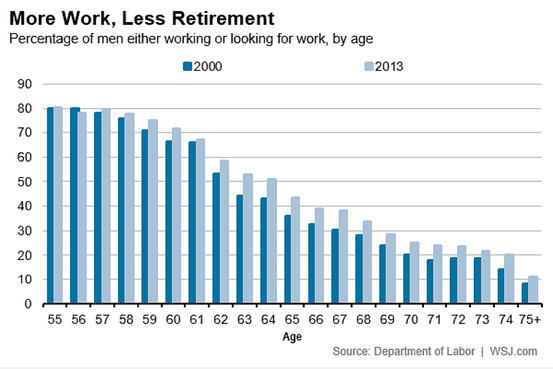

Expanding on the previous fear, the fact that there is an insufficient amount of savings left means that baby boomers will have to work past their normal retirement age in order to maintain their lifestyles. As you can see in the two diagrams below, a higher percentage of men AND women baby boomers are working. This is despite the fact that the downward trend of employment in relation to age is still in full effect.

Fear No. 5: I Might Fall Victim to Identity Theft

With little left under their name, many baby boomers hear horror stories of how their credit cards or other valuable information gets stolen and used for malicious intent. To make matters worse, by the time they manage to resolve the issue, the damage is already done and they have lost a sizeable portion of their assets. Thieves will take advantage of the apparent gullibility of baby boomers and scam them through fraudulent phone calls or other shady business deals.

Fear No. 6: My Investments Might Hurt Me

There are baby boomers who have a portion of their financial assets invested into the stock markets. Depending on the timing of the market, this could work very well for them, ruin their lives completely, or have next to no effect at all. Due to the volatile nature of the market, it is nearly equivalent to gambling and baby boomers fear that the risk they have taken will backfire on them.

Fear No. 7: I Won’t Be Able to Maintain My Current Lifestyle

Although many baby boomers do not necessarily live extravagant lifestyles, the fact of the matter is that many of them enjoy the day-to-day life that they are experiencing right now. It may require a respectable amount of cash per year that they do not have available in their bank accounts. Thus, baby boomers face the harsh reality of having to live on less money, and find new things to enjoy that are not so expensive.

Fear No. 8: I Will Lose My Independence

Before retirement, baby boomers experienced enough independence that allowed them to work the hours that they wanted, while doing what they enjoyed on their spare time. However, many baby boomers fear the loss of independence on the simple things. This includes losing the ability to drive their car, losing the home that they have spent so many years in, and avoiding the burden that they may place on their adult children to help support them.

Fear No. 9: I Haven’t Travelled Enough

One of the biggest regrets baby boomers have is that they didn’t take time to see the world and make more memories with the people they love. When it comes to retirement, they will not have the funds to take a luxurious vacation like they did when they were working. Unless they have a substantial amount of money saved up, or their family members pitch in, they’re faced with limited options that might not be the ones they want to explore.

Fear No. 10: I Don’t Know How Much Longer I Have to Live

Even amongst the most financially savvy and well-off baby boomers, they cannot predict the future. Sure, they have a hot portfolio and everything is going well, but how much longer do they have left to enjoy it? No matter the situation, every baby boomer has to face the fact that their time on this planet is limited, and it could end the very next day in the blink of an eye. In the words of the late and great Steve Jobs: “Death is very likely the best single invention of life. It is life’s change agent.”

As you can see, there are lots of fears and insecurities that go through the mind of a baby boomer. You might not be able to avoid every single one of them, but hopefully you have learned what you should do, and NOT do in terms of managing your finances. If you are a younger person reading this article, learn from the wisdom of the baby boomers and start building your financial future NOW!

Jeremy Sakulenzki is the founder of South Texas Wealth. He's the author of the book: 7 Financial Planning Mistakes Every Baby Boomer Needs To Avoid. Jeremy has a business degree from Texas A&M University and he rarely misses any of their football games. Jeremy's passion lies in helping Baby Boomers protect their retirement saving because he knows there are some things in life you only get one shot at...and retirement is one of them.

Protecting wealth - that's our goal. Putting clients first - that's our guarantee.

- Jeremy Sakulenzki, Founder & CEO